Like many trends, Industry 4.0 began as a buzzword. But it has become vitally important to businesses across the industrial, engineering and manufacturing sectors. With lifting equipment integral to those operations, how is the overhead crane and hoist sector responding to this trend?

The main facets of Industry 4.0 are automation and digitalisation, which often go hand in hand. In some respects, both are responses to challenges faced by many workplaces right now, and the most obvious is labour. “No one wants to run a crane anymore,” says Wes Jackman, commercial manager at CareGo Tek, a leader in overhead crane automation. “It’s loud, it’s dangerous and the pay is typically the lowest in the plants.”

Despite this, he notes that, initially, many companies were reluctant to invest in automation, seeing material handling as a non-value-added process. However, as recruitment and retention become increasingly challenging, more companies are turning to solutions like Carego Tek’s TELIA automation technology.

TELIA leverages automation to optimise vertical space, maximising storage capacity without compromising efficiency. CareGo Tek says this enhances operational output and cultivates an environment where safety is paramount. It is also available in a handheld version, which instructs workers on where to place inventory for optimal storage and safety.

For rubber tire gantry (RTG) crane manufacturer Mi-Jack, crane automation is now a given for workers. “The employment pool of their customer base requires these tools to be in place in order to complete tasks in a successful manner,” says Aaron Newton, executive vice president of sales at Mi-Jack Products and chief marketing officer at Lanco Group of Companies. “It’s expected at this point,” he adds.

Mi-Jack is best known for its container handling solutions in terminals. But it also has years of expertise in deploying its Mi-Star system on the East Coast for steel and concrete handling, where it powers semi-autonomous operations of Mi-Jack’s Travelift RTG cranes. Its Accusteer auto-steering module has also been used for many years on Travelift cranes in bridge construction applications.

Mi-Jack’s Mi-Star technology enables multiple RTG cranes to run without an operator. When paired with an auto-spreader, no rigging is needed, thereby making the process safer and more efficient. Semi-autonomous operation enables the machines to drive, hoist and traverse independently, requiring human intervention only for the final few feet of the operation and the actual pick. The operator can be located elsewhere and controls the machines remotely.

Mi-Star’s modules combine to provide asset, personnel, and equipment tracking, which Mi-Jack says helps with safe and efficient operations. To facilitate this functionality, the cranes are equipped with multiple positioning and steering technologies, including GPS, laser scanners and cameras. These technologies work together to ensure the safe and accurate operation of the machines.

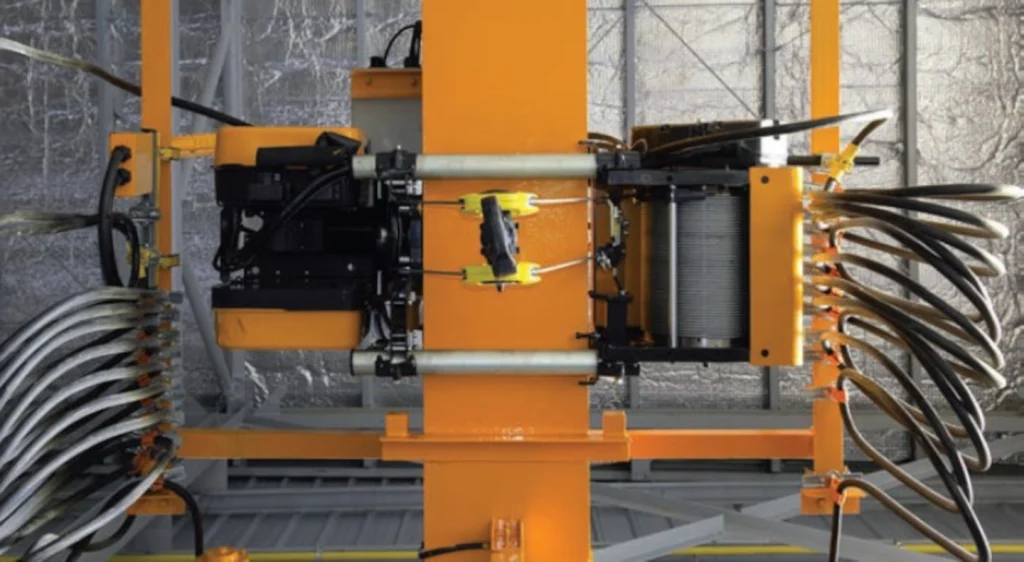

Meanwhile, the mining sector is also taking note and adopting or integrating smart technology into heavy duty hoists.

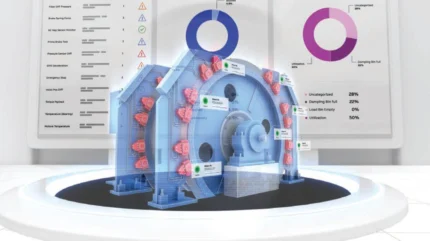

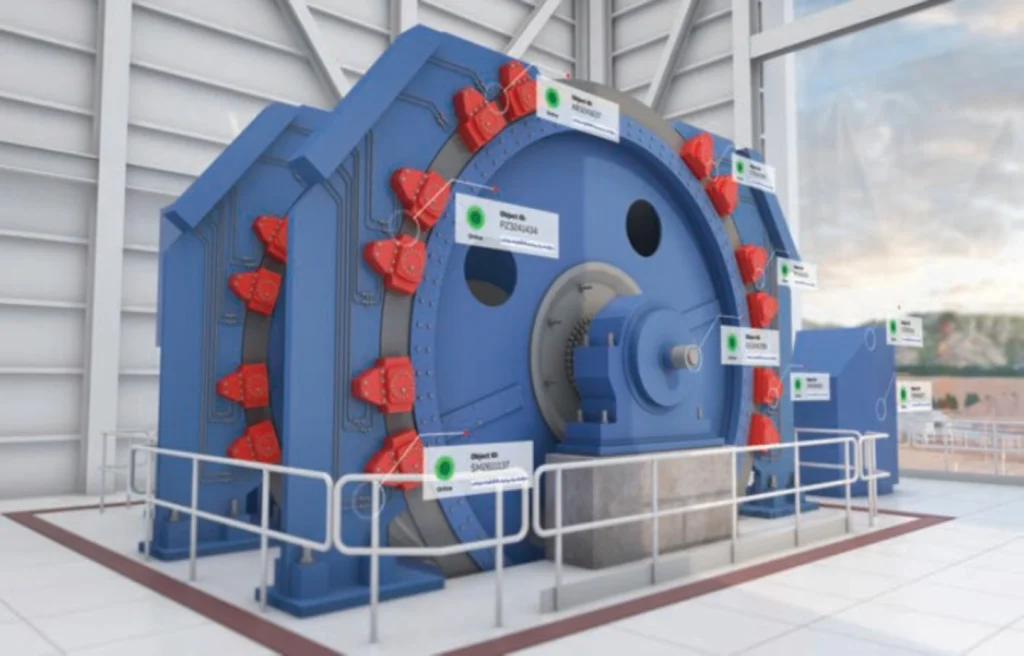

ABB sees two main approaches to modernising mining with Industry 4.0 technologies. Some are upgrading their existing hoisting equipment by adding digital features like ABB Ability Smart Hoisting. This includes advanced condition monitoring, predictive maintenance and realtime data analytics to help teams make better decisions. These upgrades allow operators to improve uptime, reduce safety risks and make smarter operational decisions without replacing entire systems.

“At the same time, we’re also seeing new mining developments invest in full-scale smart hoists designed from the ground up with digital infrastructure,” says Veselin Donchev, ABB’s global product manager hoisting service, digital lead hoisting.

ABB Ability Smart Hoist offers features like drive system monitoring, KPI tracking and remote diagnostics via ABB’s collaborative operations centres. “They’re designed to improve productivity, meet safety and environmental standards and extend equipment life, while minimising environmental impact,” he adds.

“In short, whether companies are updating old gear or buying new smart hoists, they both are aiming to have safer, more reliable and more efficient mining operations. This trend shows that industries are relying on digital tools for building long-term resilience and sustainability in mining operations, as well as cost-savings.”

Integration challenges

While a greenfield development can factor in automation and smart technologies from the outset, what is the best route forward for a going concern? “Greenfield is pretty easy,” says Jackman. “It’s a case of planning out the implementation of the material handling around other commissioning activities. A brownfield site is typically more challenging as there is likely processing equipment that the client wants to keep running, and we have to work around the production needs of the facility.”

The other challenge he sees is training and competence. “Where we see material handling automation fail is that the company installs automation and leaves, but the facility does not have the staff or know-how to handle the equipment or modify custom one-off code for a material handling system. These facilities are mostly 24/5 or 24/7, and so should their automation partner be – but small, one-off automation shops are not set up for this.”

Mi-Jack has approached integration by making Mi-Star manufacturer agnostic. “Because equipment fleets are full of a variety of brands and ages, our being agnostic allows them to have the hardware in place to see the full chain of custody for overall asset tracking,” says Newton. “This flexibility makes it desirable, and recommended, to implement the solution in its entirety, since once you have the hardware in place, you can see everything, and the value of that data helps deliver a solid ROI. Essentially, we right-size the solution for each piece of equipment and each location.”

An element of this includes trying to futureproof the technology. “We have products that have been in the field for over two decades, and they continue to work as intended,” he adds.

Beyond integration, the big challenge is cyber security. “How everyone needs to evolve now is to account for the advancements in software security,” Newton says. “The industry has to adapt to threats and so do we, and that’s the critical path on the road to future-proofing the longevity of a technology offering.”

For ABB, this is a priority. It encrypts and transmits data via secure VPNs from hoists to its collaborative operations centres, with controlled access of raw data on site. “We embed cybersecurity into Smart Hoisting from the ground up,” says Donchev. “By automating diagnostics and minimising manual intervention, we reduce exposure to cyber risks while improving reliability. Cybersecurity is absolutely integral to how we design and deliver digital services in mining.”

Another potential headache is around big data, which brings great value but can lead to drowning in information. “Everyone’s trying to absorb all of this data,” says Newton, “and they all are figuring out what to do with all of it.”

Big data can power predictive maintenance on fleet equipment through to real-time inventory insights. Mi-Jack believes that visualising this data is critical, which it enables through the Accuview graphical user interface module of Mi-Star. “Customers see how things are working in the present and use the data to help forecast how operations will be in the future based on that data and then make appropriate decisions to help ensure the best outcomes,” he concludes.

ABB has a similar view. “Along with automation, we also need digital solutions,” says Donchev. “Using existing data to make smarter decisions and doing it in a way that’s scalable and aligned with their operational goals.”

Adoption curve

While producers of fast-moving consumer goods and industrial components have embraced Industry 4.0 lifting technologies, other aspects of industry were slower to adopt. “Whereas the smaller piecemeal manufacturing-style products have long since moved into a more automated space, the larger industries such as metals have been more cautious and slower to pick up automation,” says Jackman.

In this market segment, CareGo Tek saw a sea change in attitudes towards automation after the impact of the pandemic on global supply chains. “What we find is that the interest is growing in metals,” he says. “Smart computing, through sensors and data collection, AI and vision are revolutionising what is possible in automation.

“Some of our industry’s challenges when it comes to the various sizes and shapes of the metals products and how to find locate, stack and store them, can be overcome with combinations of these technologies.”

However, there is still some work to be done. CareGo Tek is increasingly seeing client engagement around automation for material handling, but there is notably less interest in automation of storage processes.

“Currently, many companies approach this as a manual process with the expectation that it will be easy to accomplish,” says Jackman. “What they tend to find out, the hard way, is that managing inventory and maximising storage capacity are complex endeavours that require thought and consideration.”

He believes that too many companies in this space still manage inventory through a manual hand count process. “Their automated counterparts are able to quickly view inventory via dashboards and satisfy audit requests with the click of a mouse.”

Manual storage also leads to lost productivity. “Vast amounts of space are utilised by inefficient, unsafe equipment with large requirements to manoeuvre within the space. Additionally, many don’t take advantage of vertical space effectively. An automated environment not only safely moves product, but it also maximises storage density and at the same time keeps product available for the next stage in the process,” Jackman says.

For ABB, Donchev feels that mining companies are becoming more receptive to the idea of smart hoists. “It’s definitely getting easier,” he says. “A few years ago, conversations around upgrading hoisting systems were more focused on mechanical reliability and throughput. Now, with the rise of Industry 4.0, mining companies are increasingly open to digital solutions, especially when the ROI is clear in terms of safety, reliability and reduced downtime.”

The caveat he adds is that there is still a learning curve for the industry. “Concepts like predictive maintenance are gaining traction, but functional safety isn’t always front and centre in mining the way it is in other industries. ABB will often walk customers through how Smart Hoisting can help identify potential safety hazards before they escalate, using real-time data and diagnostics. For example, our system automatically monitors brake performance, motor health and drive system behaviour, which can flag issues that might otherwise go unnoticed.

“Once teams see how these insights translate into fewer unplanned stoppages and safer operations, the value becomes more apparent.”

Key benefits

On the factory floor or in the warehouse, automated material handling is a key component in intralogistics. This uses a combination of automation, sensors and the Internet of Things (IoT) to tie together a facility’s entire material handling and storage needs.

“By having one system orchestrate the movement and storage of products throughout your facility, not only do you have traceability, but you can orchestrate the right product in the right place at the right time in a manner that isn’t possible in a manual operation,” says Jackman.

One of the most attractive elements of automation is reducing costs. Robots never take breaks and can work round the clock, improving throughput. Another big benefit is in safety.

“If the material handling is automated there are a lot less safety concerns, because all automation areas should be guarded so no personnel is operating or near moving parts,” says Jackman. “This is great news for the metals industry where unfortunately many of the industry’s fatalities and incidents are associated with material handling, moving vehicles and storage areas.”

While storage is often not a priority for automation, Jackman points out that it is typically the least safe area on customer sites. “Customers are comfortable with A to B movements which are highly repeatable, but it is the less repeatable movements which happen within the less safe areas. Our goal should be to automate the areas which are a concern to put our personnel in harm’s way.”

Automation reduces the need for workers in these dense and more dangerous areas of warehouses. “Every way that we can limit personnel having to enter the area is a win for us, so for example Vision is a great tool to allow the system to see the issue and where possible auto recover and continue on.”

More to come

Automation is an innovation that will continue disrupting the material handling industry. “We most often think of cranes being automated, but a whole slew of other capabilities that extend all the way to touching the product, metal in our case, are continuing to be developed which make automation even more attractive to companies with a future mindset,” says Jackman.

However, we are also starting to see pushback from unions who see automation as a job stealer. But ABB believes it is about deploying automation in the right way. “The key is thoughtful implementation,” says Donchev. “When automation is used to enhance safety and reliability, it can be a win for both operations and the workforce. It’s not about replacing people; it’s about making their jobs safer and more effective.”