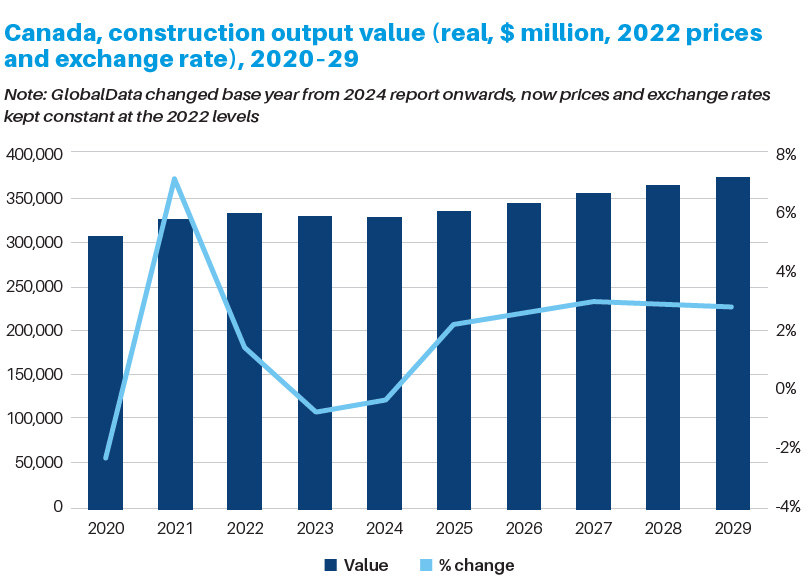

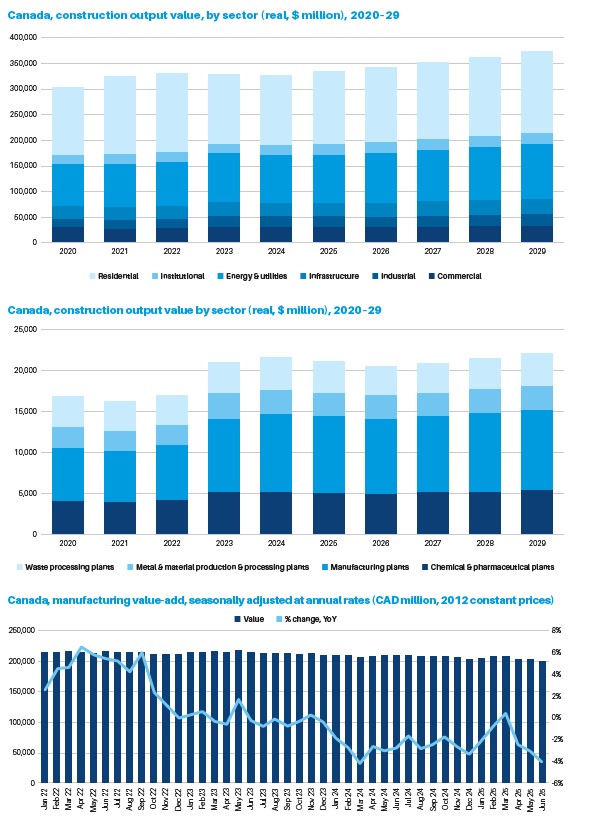

After two consecutive years of gradual decline in 2023 and 2024, GlobalData forecasts that Canada’s construction industry will grow by 2.2% in real terms in 2025.

Nevertheless, the sector will continue to face pressures in 2025 due to escalating political tensions between Canada and the US, triggered by President Donald Trump’s tariff actions. In August 2025, the US government widened steel and aluminium tariffs on Canadian imports, imposing 50% duties on 407 additional product categories containing steel and aluminium.

The Canadian construction market is also expected to contend with rising unemployment, further supply chain disruptions, and ongoing economic deterioration – factors likely to weigh on the industry over the coming year. Even so, the sector is projected to rebound in 2026 and record an average annual growth rate of 2.6% from 2026 to 2029.

Industrial outlook

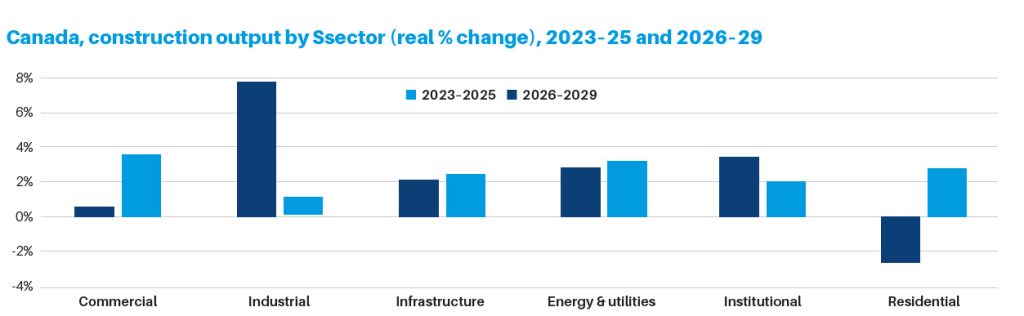

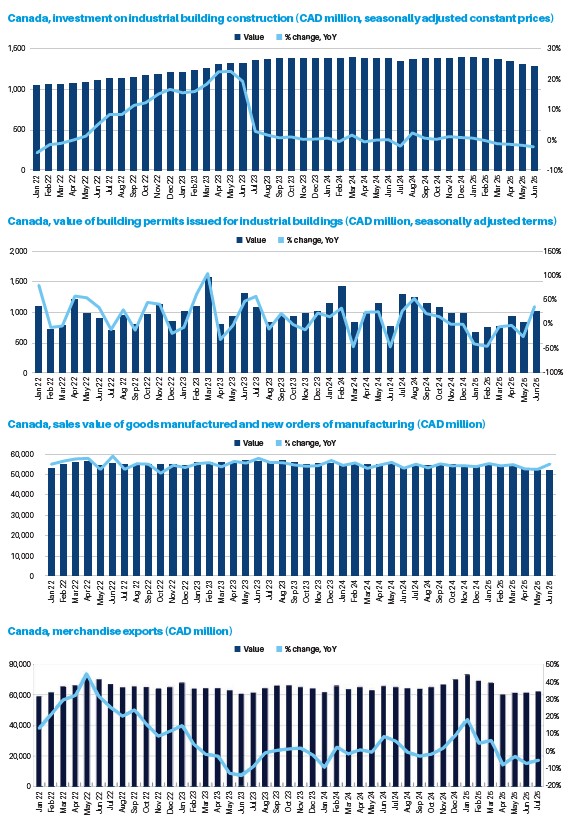

The industrial construction sector is projected to shrink by 2.1% in 2025 and a further 2.9% in 2026, driven by falling industrial building permit values and heightened supply chain disruptions linked to uncertainty around US tariffs. Statistics Canada reports that investment in industrial buildings declined by 2.5% YoY in the first half of 2025, while industrial building permits dropped by 21.6% YoY during the same period.

The sector will also continue to be affected by steep duties on Canadian steel and aluminium.

In August 2025, the US Department of Commerce extended its steel and aluminium tariffs to 407 new product categories, applying 50% duties on their steel and aluminium content. This will influence the production of steel and aluminium containing goods in Canada destined for US markets. These tariffs have also raised exporters’ costs by increasing prices in the US, reducing demand and eroding Canadian market share.

Despite these challenges, the broader construction industry is expected to recover between 2027 and 2029, with an average annual growth rate of 2.5%. This outlook is supported by government measures to safeguard the steel industry from tariff-related instability and by increasing private investment in manufacturing.

As negotiations with the US continue, Canada removed counter-tariffs on most US goods in August 2025 – except those on steel and aluminium. The US also clarified that it would not impose tariffs on Canadian goods compliant with the US-Mexico-Canada Agreement (USMCA), allowing most goods to continue to trade freely.

This is expected to help limit near-term economic damage by easing inflationary pressure.

To further reduce strain on automotive manufacturers, the Canadian government announced a one-year delay in the rollout of its zero-emission vehicles (ZEV) sales mandate. Originally planned for 2026, it required that 20% of new passenger cars sold be ZEVs, increasing annually to reach 100% by 2035.

Among recent developments, German battery cell manufacturer PowerCo awarded its first major construction contracts in August 2025 for a CAD9.6bn ($7bn) EV battery plant in St. Thomas. The facility will include six production blocks on a 140ha site and is scheduled for completion by the end of 2027.

Project analytics

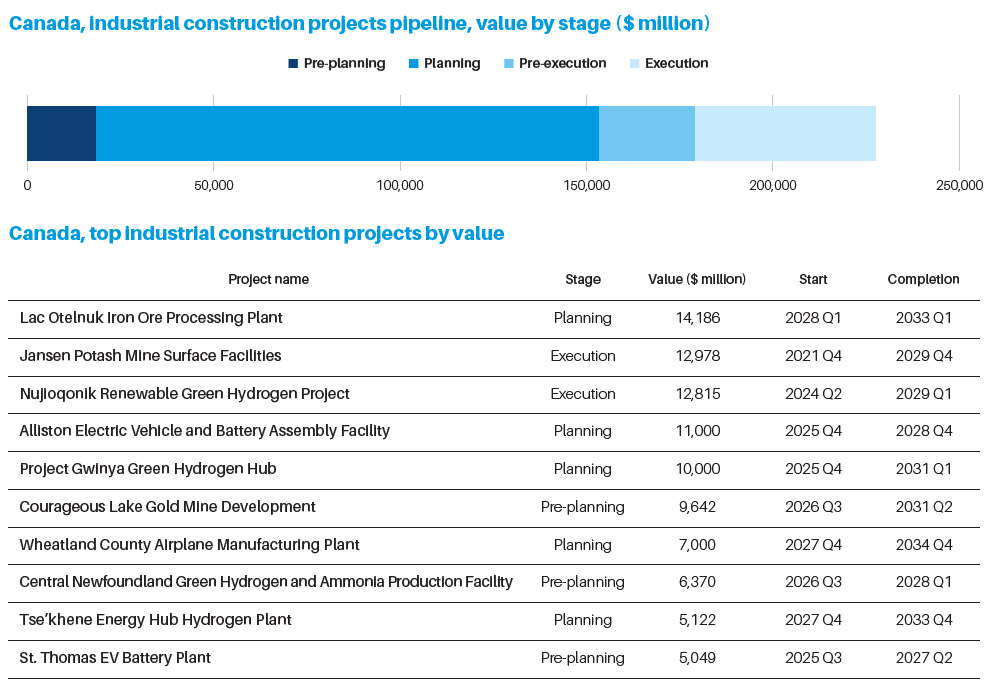

Canada’s industrial construction pipeline – covering all projects above $25m – totals $227.9bn, as tracked by GlobalData. As of September 2025, 67.3% of this value is in early stage planning or pre-planning.

The largest project in the pipeline is the $14.2bn Lac Otelnuk Iron Ore Processing Plant, which includes primary and secondary crushing facilities, product screening, a dry processing system, product sampling stations, rail siding, storage, and administrative buildings.

Another major project is the $13bn Jansen Potash Mine Surface Facilities, involving excavation of two 6.5m shafts approximately 1,005m deep, with a 160,000t on annual capacity.

Additional work includes service shafts, a head frame and hoist, six underground borers, essential surface infrastructure, and a freezing plant.