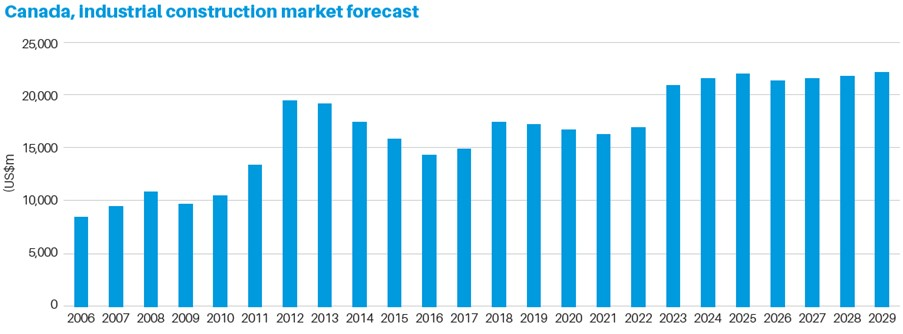

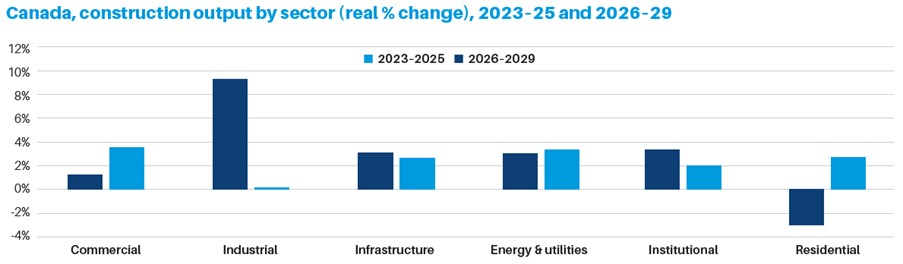

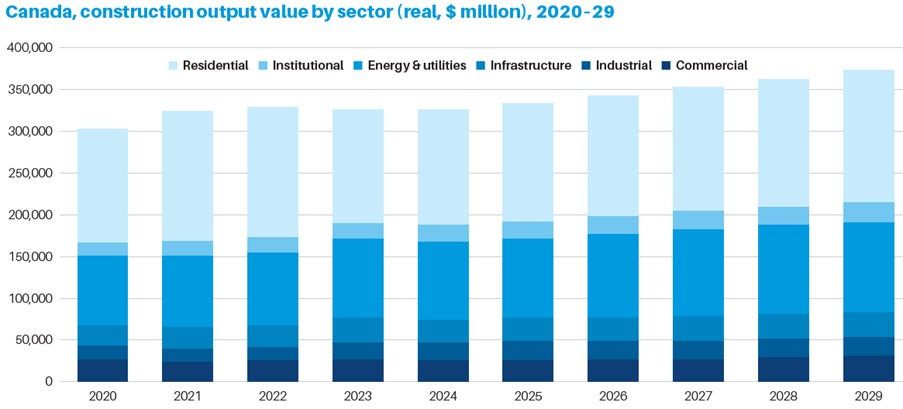

The construction industry in Canada is set to expand by 2.6% in real terms in 2025, returning to growth after two years of decline. The construction industry is also set to continue its growth throughout this forecast period, experiencing an annual average increase of 2.8% during 2026–29. This will be supported by developments in the transport, energy and residential sectors, as well as the ‘Investing in Canada’ plan initially launched in 2016.

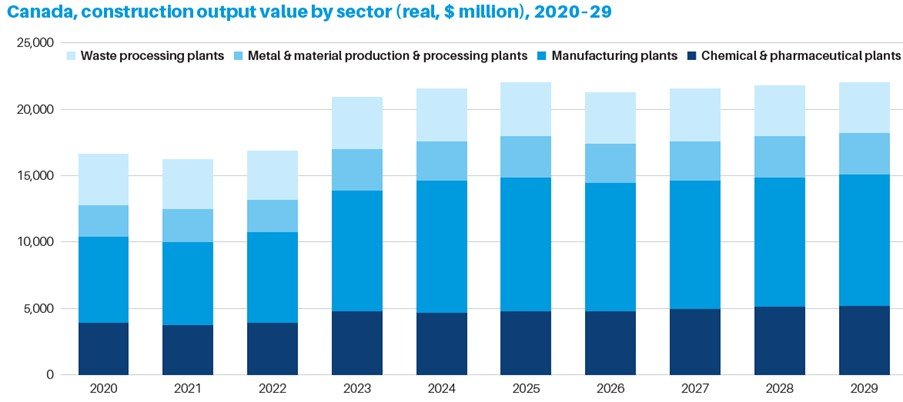

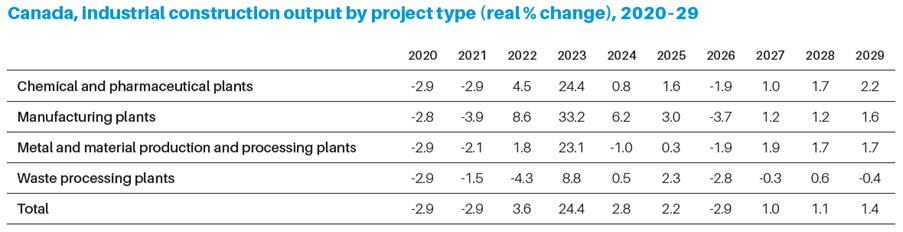

The industrial construction sector, following an annual growth of 2.8% in 2024, is expected to record slower real term growth of 2.2% in 2025 before recording an annual decline of 2.9% in 2026. This comes amid expected headwinds caused by the challenges brought on by the uncertainty surrounding the potential US tariffs and following supply chain disruptions. However, the industrial construction sector is expected to grow at an annual growth rate of 1.2% in 2027–29, supported by waste processing and manufacturing project investment.

Industrial construction outlook

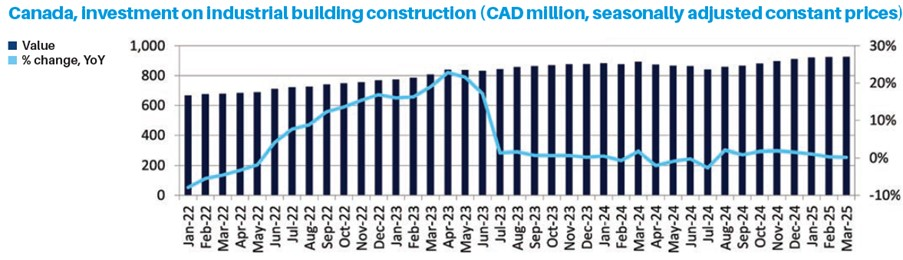

With an annual growth of 2.2% expected in 2025, according to Statistics Canada, the total value of investment in industrial buildings grew by 4.6% YoY in Q1 2025, following the previous years’ growth of 4.4%. The sector is expected to experience an annual decline in 2026 of 2.9% amid the uncertainty around the US tariffs and the subsequent supply chain disruptions and rising construction material costs. As the largest supplier of steel and aluminium to the US, the 50% tariff on Canadian steel and aluminium exports – enacted in early June 2025 – will have significant impact on businesses and reduce their investment capacity and margins.

According to the Bank of Canada, the ongoing US-Canada tariff war is likely to impact farmers in the Prairies who are greatly reliant on US phosphate and US equipment and machinery. This could lead to a phosphate deficiency in Canada, reducing crop yields and have knock-on effect that could lower production for Canadian agricultural-based industries. With China’s 100% tariff on Canadian canola oil, pea and oil cakes, as well as a 25% tariff on Canadian aquatic product and pork, this will impact sector investment and limit expansion.

The national industrial vacancy rate surged to 4.8% in 2024, according to the Canadian Real Estate Association (CREA), compared with 3.2% in 2023, with vacancy rates exceeding over 6% in Montreal and Calgary. This increase can be linked to rapid expansion due to expected growth of e-commerce that failed amid ongoing challenges. This may dampen investor confidence and lead to less industrial construction spaces built over the medium term. GlobalData forecasts that the industrial construction sector will grow at an annual average growth rate of 1.2% between 2027–29, supported by waste process and manufacturing investment.

The sector will also be boosted by the country’s focus on reaching 100% zero-emission vehicle sales targets by 2035. Among the major construction projects tracked by GlobalData in the automobile sector is the construction of a car manufacturing plant in Windsor, Ontario, by the Italian automobile company Fiat Chrysler Automobile Group. Expected to involve a total investment of CAD3.5bn ($2.8bn), the project construction is set to commence Q4 2027 and end Q2 2031.

Project analytics

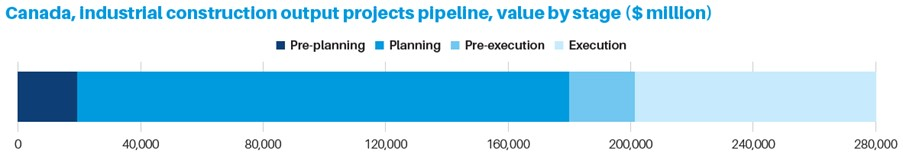

The industrial construction projects pipeline in Canada stands at $249.7bn. The pipeline, which includes all projects from pre-planning to execution with a value above $25m, is skewed towards early-stage projects with 72.2% of the pipeline value in projects in the pre-planning and planning stages, as of June 2025.

The largest industrial project in the pipeline is the $14.2bn Lac Otelnuk Iron Ore Processing Plant. The project involves the construction of a primary and secondary crushing facility, a product screening facility, a dry processing system, product sampling stations, a rail siding, a storage facility and an administrative facility.

Another important project in the works is the $13bn Jansen Potash Mine Surface Facilities. The project involves the excavation of two, 6.5m shafts approximately 1,005m in depth with a capacity of 160,000t per annum. Additionally, construction will also involve the installation of service shafts, head frame and hoist, six underground borers and essential surface infrastructure, as well as the construction of a freezing plant.

Latest news and developments

Manufacturing value-add continues to decline. According to Statistics Canada, the manufacturing industry’s value-add fell by 0.6% YoY in March 2025, preceded by YoY decline of 1.3% in February and 2.7% in January 2025. The average manufacturing industry’s value-add fell by 1.6% in the first three months of 2025, compared with the same period of 2024. This came after a 2.8% annual decrease in 2024.

There is marginal investment growth in industrial buildings. According to Statistics Canada, the total value of investment in industrial buildings grew marginally by 0.2% YoY in March 2025, following YoY growths of 0.3% in February and 1.1% in January 2025. The total industrial building construction investment grew by 4.6% YoY in Q1 2025. This was preceded by an annual growth of 4.4% in 2024.

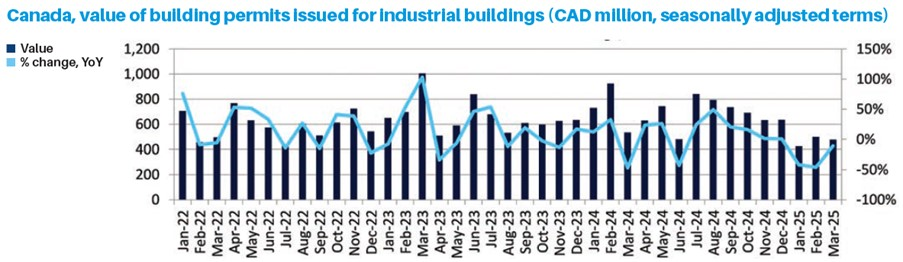

Meanwhile, industrial permits continue to fall. According to Statistics Canada, the total value of industrial building permits issued in the country fell by 10.9% YoY in March 2025, following YoY declines of 46% in February and 41.8% in January 2025. In Q1 2025, the value of industrial building permits fell by 36% YoY. This was preceded by an overall annual growth of 5.1% in 2024.

Further, manufacturing sales are falling while new orders are growing. According to Statistics Canada, the total sales value of manufactured goods fell by 1.3% YoY in March 2025, while the total value of new manufacturing orders grew by 1.9% YoY in March 2025. In total, sales value of manufactured goods fell by 1.2% YoY in Q1 2025, whereas the total value of the new manufacturing orders grew marginally by 0.2% during the same period. This was preceded by annual decline of 2.2% for both manufacturing sales and manufacturing new orders in 2024.

According to Statistics Canada, the total value of merchandise exports fell by 7% YoY in April 2025, mainly due to the impact of tariff war with the US. This was preceded by YoY growths of 6.7% in March and 5.2% in February 2025. Altogether, the total value of merchandise exports grew by 5.8% in the first four months of 2025. This was preceded by an annual increase of 1.2% in 2024.

Finally, the Canadian government is providing funding for a project in Edmonton. The German building materials company, Heidelberg Materials, secured the carbon capture, utilisation and storage (CCUS) project from the Canadian government’s Innovation, Science and Economic Development Canada body in March 2025. It involves the construction of the CCUS system with a combined heat and power system at its Edmonton cement plant. The project involves a funding of CAD49 million ($35.9m) for the project from the Canadian government.